28+ Citizens bank mortgage rates

Visit Citizens for todays home mortgage rates. SVR mortgages usually have higher interest rates than other mortgage options.

Infographic Anatomy Of A Reverse Mortgage Mortgage Infographic Reverse Mortgage Mortgage Payment Calculator

A certificate of deposit CD is a savings product offered by a bank in which a depositor someone who has money to put into the bank agrees to commit a certain amount of money for.

. These rates are indicative only and are subject to change without notice. Offer valid on most new mortgage applications received and completed between July 14 2022 and Oct. 2 min read Selling a home in Tennessee.

A homeowner who is above 60 years of age is eligible for reverse mortgage loan. Vio Bank CD rates are competitive right now but only on the banks shorter-term certificates of deposit. The greater the lender thinks that risk is the higher the rate the bank will charge.

The scheme of reverse mortgage has been introduced recently for the benefit of senior citizens owning a house but having inadequate income to meet their needs. Standard variable rates move based on fluctuations in the Bank of England base rate. Offers an underwriter reviewed preapproval letter in as little as 24 hours.

Heres a look at the current Citizens Bank new account bonus offers. From Monday to Friday between 8 am and 8 pm we operate our helpline in Ukrainian language at 48 22 598 40 45. From Less than INR 2 Crore.

8 days up to 14. Initial Deposit to Open Daily Account Balance Annual Percentage Yield APY 005. Active accounts have been in use within the past six 6 months.

And any mortgage insurance be 28 or less of your gross monthly income. For example current 6-month CD rates from Vio Bank are at 164 percent with an APY of 165 percent. Appraisal guarantee promises the loan wont change even if appraisal.

For senior citizens rates as per above table would apply. Is a key part of our First Citizens DNA and we are proud of the achievements of the First Citizens Group over the past 28 years in impacting the lives of those we serve. American Express Bank of America Capital One Chase Citi and Discover.

For example if you open an account in October 2022 your bonus will be paid by Feb. Explore our 15- and 30-year home mortgage rate options to find the one for you. For example if your annual household income is 120000 your gross monthly income would be 10000.

For 500000 how much is monthly cost. An application submitted through the Truist Online Mortgage Application portal is not completed until you speak with a mortgage loan officer. Certificates of Deposit - Branch Banks 2022.

It can also depend on how long you want to take out a loan or mortgage for. Non-resident Spanish mortgages are usually fixed-rate and have a term of no more than 20 years. Makes it easy to see customized mortgage rates.

We are introducing a simplified account opening process and waiving fees for Ukrainian citizens. 30 year fixed rate mortgage loan. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

For loans other factors are considered including the risk of the loan not being paid back. Therefore youd want to keep their. 30-year mortgage rates.

Check out the interest rates of different DBS Bank India deposit account like saving accounts fixed deposit and NRE NRO account interest rates on home loan. To find the best mortgage rates we analyzed all 30-year loans from the biggest lenders in 2021 the most recent data available. Rates surge further past 6 a 14-year high.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Lender credit of 500 applied toward closing costs on a Truist mortgage. Long-term CD rates at Vio Bank are not as competitive when compare to other online rates.

The interest rates high street banks set depend on more than just Bank Rate. 28 th July 2022. Some important features of reverse mortgage are.

Provider Branch Founded Country Ownership. 12 The companies with the lowest mortgage rates on average are. 178 percent to 199 percent for average credit scores of 630 to 689 and 285 percent to 320 percent.

First Citizens Investment Services. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Inactive accounts have had no activity for at least six 6 months.

According to data from the Bank of England mortgage approval. Furthermore while mortgage interest rates for Spains residents are at historic lows around 15 in the third quarter of 2021 interest rates for non-resident mortgages can reach 225. To re-activate an Inactive account you must visit a First Citizens branch to make a minimal cash deposit into the.

Citizens Bank Statement Template Mbcvirtual Statement Template Bank Statement Word Template

Longspur Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

Craig Leboeuf Originating Branch Manager Cross Country Mortgage Linkedin

2

Longspur Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

Craig Leboeuf Originating Branch Manager Cross Country Mortgage Linkedin

Craig Leboeuf Originating Branch Manager Cross Country Mortgage Linkedin

1

Longspur Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

Idbi Bank Introduces Reverse Mortgage Loan For Senior Citizens It Seeks To Monetize The House As An Asset A Mortgage Loans Refinance Mortgage Reverse Mortgage

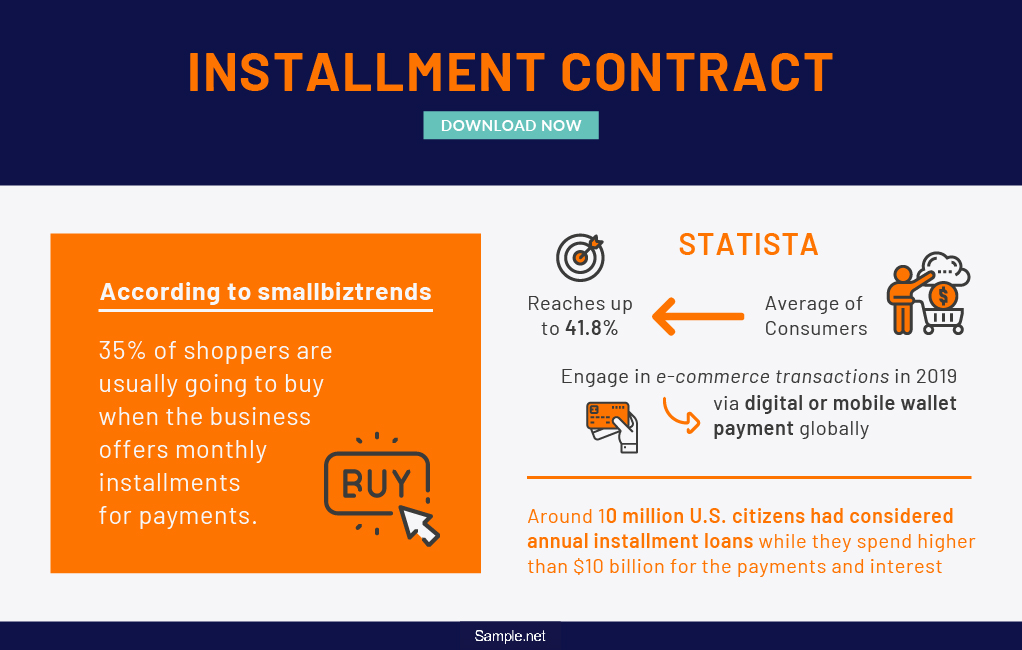

28 Sample Installment Contract Templates In Pdf Ms Word

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

1

Craig Leboeuf Originating Branch Manager Cross Country Mortgage Linkedin

Craig Leboeuf Originating Branch Manager Cross Country Mortgage Linkedin

Other Entities First Citizens Bank First Citizens Pennsylvania State University

First Citizens Bank Mobile App Redesign First Citizens Bank First Citizens Mobile App